Growth Strategy

Portfolio Building Policy

▪Qualities considered by the Investment Corporation to be strengths of a diversified REIT

| ❶ | Able to make flexible investments with respect to purpose of use and area and thereby acquire properties which will contribute to the maximization of cash flow. |

|---|---|

| ❷ | Able to reduce portfolio concentration risks by aiming to diversify the portfolio by purpose of use as well as diversifying the portfolio areas. |

| ❸ | Able to secure the potential for expanding portfolio size through the maximization of acquisition opportunities. |

| ❹ | Able to develop new earning opportunities by gaining a proper understanding of the changes in future real estate needs and flexibly responding thereto to achieve ongoing growth. |

| Investment Ratio by Type (Based on acquisition price) (Note 1) |

Characteristics of Asset Type | |||||

|---|---|---|---|---|---|---|

| Growth Stability | Office 30~60% |

|

||||

| Residential 10~30% |

|

|||||

| Retail 30~60% |

|

|||||

| Others 0~20% |

|

Investment Ratio by Area (based on acquisition price) (Note 1)

| Tokyo Metropolitan Area Approx. 50% |

Regional Major Cities Approx. 40% |

Others Approx. 10% |

Investment Criteria (Note 2)

Investment criteria is established for purpose of use and properties are selected with focus placed on the following.

Office

| ⃝ | Buildings located within 10 minutes walking distance from the nearest station |

|---|---|

| ⃝ | Buildings with steady tenant demand |

| ⃝ | Buildings with a leasable area of 1500m2 (2,500m2 or more for properties location in regional major cities) |

Retail

| ⃝ | The existence of a population within the market area relevant to the characteristics of each of the retail facilities which will contribute to sales in such facilities (including verification of future demographics) |

|---|---|

| ⃝ | A majority of tenants are under fixed lease building agreements where early termination is not possible for at least for three years as a rental income base. |

Residential

| ⃝ | Family housing shall be located within 10 minutes walking distance from the nearest train station or where located more than 10 minutes away from such services, shall be equipped with parking for all units. |

|---|---|

| ⃝ | Buildings with easy access to educational facilities and life-style oriented retail facilities |

| ⃝ | Housing for single dwellers shall be located within 10 minutes walking distance from the nearest train station |

| (Note 1) | The ratios in the above are our target ratios for our asset investment over the medium to long-term which depending on the real estate market and future property acquisitions. We may temporarily exceed or fall below. |

|---|---|

| (Note 2) | The Investment Corporation may individually examine the characteristics of properties which do not fulfill some of the above criteria and acquire the same upon comprehensively considering these factors. |

Leveraging Property Sourcing (Procurement) Capabilities of Sponsors

The Investment Corporation receives extensive property sales information from Galileo and Nippon Kanzai Group’s core companies based on the Sponsor Support Agreement and aims to achieve external growth by examining the aggressive acquisition of properties which match its investment policies.

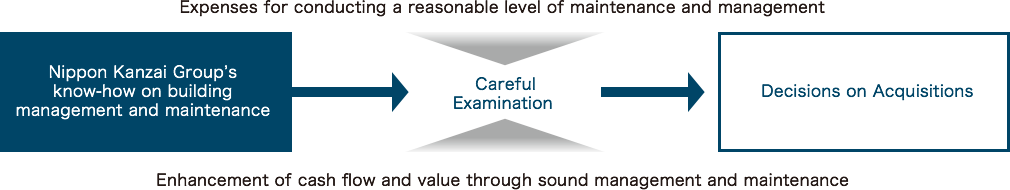

Investment Decisions based on Close Examination of Properties

The Investment Corporation makes decisions on property acquisitions based on careful examination of the potential to increase the value of properties being examined for acquisition through the execution of sound of management and maintenance which is suited to the cash flow thereof. By making investment decisions in this way, it is also possible to make investments in properties not considered to be investment grade at the current maintenance and management levels.