Sponsor Overview

- Overview of Galileo Group

- Overview of Nippon Kanzai Group

-

Support from Galileo Group

and Nippon Kanzai Group

Overview of Galileo Group

Galileo Group is an independent Australian real estate and fund management group with a proven track record in various real estate investment and developments. It has experience and know-how in various aspects of real estate investment and development including investment property acquisition and value increase as well as financing through equity and loan transactions in Australia, Japan and the U.S. Galileo Group has listed two A-REITs and its management team has up to now been involved in the listing process and management of an additional 6 A-REITs. It first became involved in investment activities and management of real estate located in Japan in 2006 and will continue to undertake these activities in the Japanese real estate market through the provision of sponsor support to the Investment Corporation.

| (Note 1) | A preventative and proactive investment approach to the handling of future anticipated problems. The same applies hereafter. |

|---|

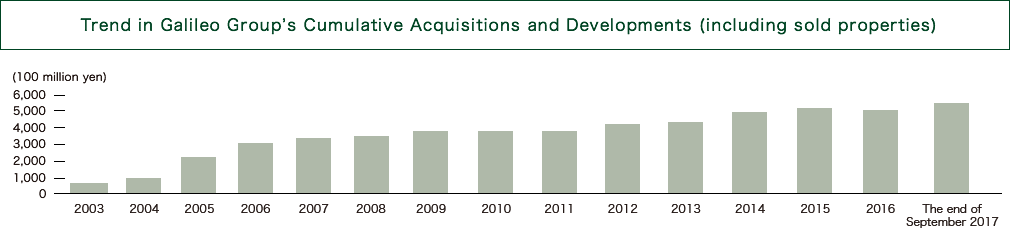

Galileo Group's Performance

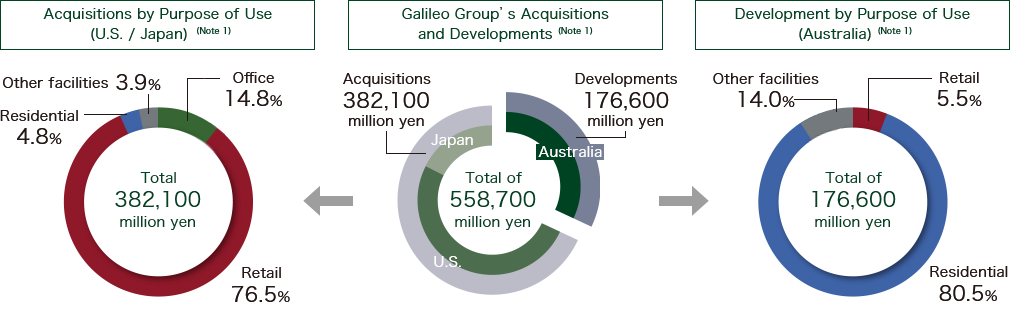

The Galileo Group since establishment in 2003 has completed real estate acquisitions and developments of approximately 560 billion yen (Note1) in Japan, Australia and USA.

| (Source) | Galileo Group |

|---|---|

| (Note 1) | Exchange rates applicable as of September 29, 2017 |

| (Source) | Galileo Group |

|---|---|

| (Note 1) | Cumulative figures from 2003 to the end of September 2017. |

Investments in Japan

| ・ | In 2006, established GJT whose investment targets are real estate in Japan and listed the same on the Australian Securities Exchange. |

|---|---|

| ・ | After listing GJT in 2006, acquired 21 properties at 57 billion JPY(total acquisition price). |

| ・ | In 2007, achieved capital increase of approx. 120 million AUD (10.2 billion JPY) |

| ・ | Over 2007 to 2008, acquired an additional 5 properties at 31.8 billion yen (total acquisition price). |

| ・ | Achieved an average occupancy rate of 97.6% (Note) for a total of 26 properties held since the listing of GJT over the period it held the properties. |

| ・ | From 2006 to present, has carried out real estate management of a total of 33 properties worth over 98.3 billion JPY through GJT and other funds (total acquisition price). |

| (Note) | Period from listing of GJT to end of December 2015. Occupancy rate prior to acquisition and occupancy rate of properties sold after sale are not included. |

|---|

Developments in Australia

| ・ | Over 2009 to 2014 completed construction projects of condominium buildings with a total of 848 units in Sydney and Brisbane. |

|---|---|

| ・ | As of June 3, 2016 is involved in construction projects of several condominiums in Sydney and plans to have 583 units ready to supply between 2017 to 2019. |

| ・ | As of June 3, 2016 is involved in residential land development in Melbourne and manages 314 lots of land. |

| ・ | Has completed the development of a shopping center in Sydney with a valuation of 110 million AUD (9.7 billion JPY) and currently independently owns and manages the same. |

Investments in the U.S.

| ・ | In October 2003, listed Galileo Shopping America Trust with U.S. based assets on the Australian Securities Exchange. |

|---|---|

| ・ | After listing in 2003, acquired 51 U.S. shopping centers at approx. 570 million USD (69.1 billion JPY) (total acquisition price) |

| ・ | Over 2004 to 2007, acquired 96 U.S. shopping centers at approx. 1.51 million USD (182.1 billion JPY) (total acquisition price) |

| ・ | Achieved a capital increase through public offering of approx. 530 million AUD (46.7 billion JPY) between 2003 and 2007 |

| (Note 1) | Except for Shiroi Logiman, Azabu Amerex BLDG. and Takadanobaba Access, all the above properties are residential properties and retail facilities which Galileo Group has developed or managed in the past and as the Investment Corporation does not target overseas real estate for investment, the same are not acquisition targets therefor. |

|---|---|

| (Note 2) | Foreign exchange rate calculated based on the customer Telegraphic Transfer Middle Rate of Tokyo-Mitsubishi UFJ, Ltd. as of December 30, 2015 (1 USD=120.61 JPY and 1 AUD=87.92 JPY) |